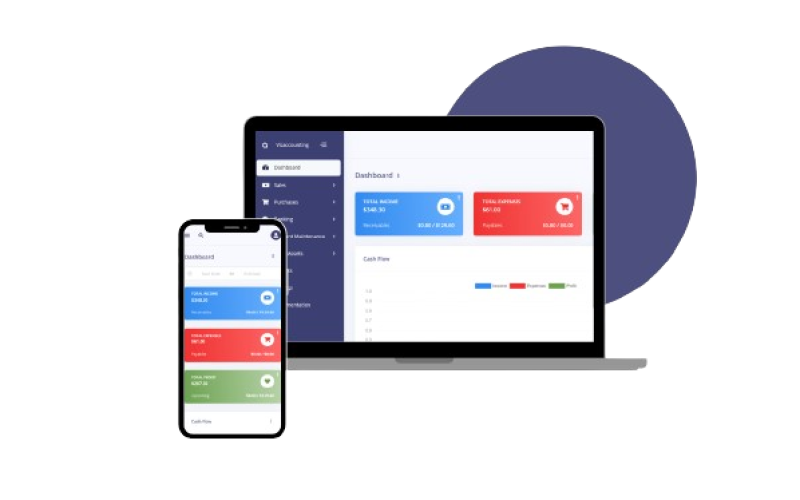

Enjoy seamless integration with our app

and bid farewell to workflow disruptions.

Efficiency in Numbers, Clarity in Finances

Vizaccounting offers robust accounting solutions to simplify financial management, ensuring accuracy and insight for your business

All the Best Benefits to Optimize Your Business Growth

Every business is unique, and so are its accounting needs. Our app offers unparalleled customizability to ensure it perfectly fits your specific requirements. Share your needs with us, and we'll handle the rest, provided it aligns with standard practices. Unlike rigid alternatives, our app adapts to you, not the other way around. Discover the freedom of accounting software designed with your business in mind.

Efficiency

Streamline financial processes, reduce manual effort, and save time on tasks like invoicing, reporting, and payroll management

Accuracy

Ensure precise financial records and reports, minimizing errors and discrepancies that can impact decision-making and compliance.

Insight

Gain real-time visibility into financial health with detailed reports and analytics, enabling informed decision-making and strategic planning

Compliance

Stay compliant with tax regulations and financial reporting standards, avoiding penalties and ensuring transparency in audits.

Key Features

Streamlined invoicing and billing for smooth cash flow

Effortlessly manage your financial transactions with automated bookkeeping, ensuring accurate and organized records without manual effort

Double-Entry

Follows the double-entry bookkeeping method to maintain accurate records of financial transactions

Double-entry accounting is the cornerstone of accurate financial record-keeping, ensuring every transaction is recorded with equal and offsetting debits and credits.

Invoicing, Billing & Payments

Manages invoicing cycles, tracks payments, and ensures efficient billing processes

Invoicing, Billing & Payments integrates essential functionalities to manage invoicing cycles, track payments, and streamline billing processes within a unified system

Recur Everything

Automate and Simplify All Your Recurring Transactions for Seamless Accounting

Recur Everything streamlines your accounting process by automating recurring transactions.

Expense Tracking

Monitors business expenses to control costs and improve budgeting

Expense Tracking monitors and records business expenses incurred for operations, supplies, travel, and other business activities

Financial Reporting

Generates reports such as balance sheets, income and cash flow statements.

Financial Reporting generates comprehensive reports that summarize the financial performance and position of a business

Fixed Asset Management

Tracks and manages the depreciation and maintenance of fixed assets

Fixed Asset Management tracks and manages the lifecycle of fixed assets, including acquisition, depreciation, maintenance, and disposal

Tax Management

Assists in calculating, filing, and reporting taxes accurately and on time

Tax Management assists businesses in calculating, filing, and reporting taxes accurately and timely